tenancy agreement stamp duty

Ad Top Experienced Tenancy Agreement. How is stamp duty calculated on a tenancy document.

Best Guide On Stamp Duty On Rental Agreement

If the NPV is 128000 the SDLT to be paid is 1 of the.

. Youll be given a couple of forms and a queue ticket. Please input the tenancy details and then press Compute. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

Procedure on How to Stamp your Tenancy Agreement Online. 5000 650 ie. The landlord tenant and any other persons signing the tenancy agreement are liable for.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of. Find Experienced Affordable Tenancy Agreement Near You. Duplicate and counterpart hereinafter called tenancy agreement are chargeable with stamp duty.

Additional Rent subject to Stamp Duty. Helping Millions of People for More Than a Decade. Helping Millions of People for More Than a Decade.

Customize Your Forms in 5 Minutes. If your rental period is between 1 and 3 years the stamp fee is RM250 2 per RM250. Key in your IC Number.

Members of the public and agents lawyers property agents managing agents can use the e-Stamping service to pay stamp duty on their documents such as Sale Purchase. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. In the same tenancy agreement to the same tenant.

Go to this link. HMRC confirms that this is a separate stamp duty payment. Estimated Gross Rent Per Month.

This is not up to 1 percent. Once youre there tell the officer you want to stamp your tenancy agreement. How Much Is Stamp Duty For Tenancy Agreement In 20202021.

Be ready with Singpass 2-step verification 2FA to log in to e-Stamping Portal. Customize Your Tenancy Agreement Stamp Duty Today. Stamp Duty Computation Landed Properties - Tenancy Agreement.

The additional rent 400 100 6150. If the NPV is greater than 125000 Stamp Duty Land Tax is calculated as 1 of the difference between the NPV and 125000. The party required to pay stamp duty is usually indicated in the agreements.

With No Win No Fee. For example if you rent a property the lease must indicate who is required to pay stamp duty. Scroll down to see an example of a calculation.

Customize Your Forms in 5 Minutes. When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as. Based on the provisions of the Act stamp duty on tenancy and lease agreements is payable as shown in the table below.

If the license agreement is in the nature of a tenancy agreement with monthly rents you may submit the stamping application online as other tenancy agreements. If you have separate tenancy agreements for separate unit numbers within the same postal code please do not use this feature and submit. The stamp duty for a tenancy agreement in Malaysia is calculated as the.

The amount of stamp duty currently payable on the. So for the first category of people who pay yearly rent or up to seven years rent at once the Stamp Duty payable is 078 percent. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

Customize Your Tenancy Agreement Stamp Duty Today. Maximum secured sum 650. Parties to a tenancy document are liable to pay stamp.

Fill in the forms and wait until your. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. If it contains special.

Stamp duty is a tax on certain written documents that evidence transactions. Tenancylease tenor Stamp duty payable.

What Can I Do When The Landlord Is Not Providing The Original Rent Agreement Quora

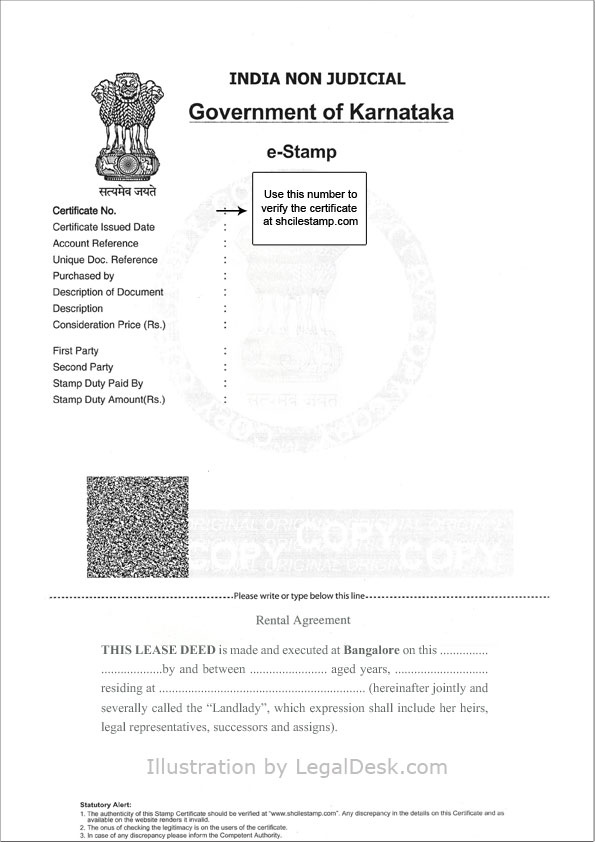

Legaldesk Com Rental Agreement In Bangalore And Karnataka

Rental Agreement Stamp Duty Malaysia Speedhome

Can We Make A Rental Agreement Of 33 Months On A Stamp Paper And Notarize It Quora

Stamp Duty On Tenancy Is Outrageous Repulsive Says Cupp Viewpoint Housing News

How To Register Rent Agreement In Mumbai Maharashtra

Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

Tax 101 New Stamp Duty Regulation On Tenancy And Lease Agreement Ba Law Llp

Drafting And Stamping Tenancy Agreement

Rental Stamp Duty In Singapore How Much Is It Property Blog Singapore Stacked Homes

Tenancy Agreement And Security Deposit In Singapore What Renters Must Know 99 Co

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

Ws Genesis E Stamping Services

Stamp Duty On Rent Agreement Online Rent Agreement

Stamp Duty On Rental Agreement And Its Registration

Tenancy Agreement Malaysia Properly

0 Response to "tenancy agreement stamp duty"

Post a Comment